The Two Minute Review

Starling is a challenger bank that is definitely worth checking out. Along with Monzo, its digital offering is the best out there on the market. However, First Direct and Chase Bank are currently keeping it off The Grade top spot.

PROS

- 📱 Fantastic mobile app and digital experience.

- 🙋♂️ 24/7 customer support.

- 💰 Jam packed with cool features like saving pots.

- 🙂 Straightforward to open.

CONS

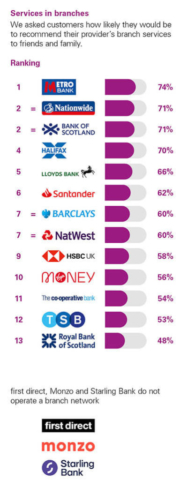

- 🏦 No branches.

- 📈 15%-35% interest on overdrafts could be more competitive.

Ranked #3 of 25 personal current accounts in the UK.

What The Experts Say

4.7/5

Starling is a great option if you live in the UK. It could easily replace your old bank. Also ideal for UK-based travellers.

If you love the idea of your walking around with your bank in your pocket, this is a great choice.

(i)t is not surprising that Starling Bank has won so many plaudits.

What Users Say

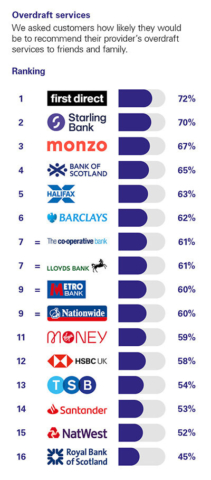

Each year the CMA (Competition and Markets Authority) commissions an independent report that asks a thousand customers of each of the major banks in the UK how they feel about various aspects of the service they are getting. The results put Starling in joint first position with Monzo.

Click to see the full picture.

4.3/5

Trustpilot has an impressive Trustpilot rating but here at The Grade we like to dig a bit further.

When you exclude reviews the company has itself invited and look just at organic reviews, the average score is 2.44. In terms of organic Trustpilot rating this means Starling is number 3 out of the 24 personal banks/current accounts we review.

3.9/5

Generally Google Reviews are favourable. Here is a representative review:

“So glad we moved to Starling Bank. Absolutely seamless transition from our old banks. We had our cards within a few days and everything was moved across within a week. Delighted with the services provided. Currently on holiday and so happy to not be charged for using our card anywhere ( purchases and cash withdrawals). Love the app and all its functions. Simple to use and easy to access . Can’t praise the bank highly enough. So happy with our choice. Thank you!”

The Deepdive

Starling in a Nutshell?

Founded in 2014 and now with over 3 million customers, Starling is a challenger bank that is fast becoming a mainstay of British Banking. It won Best British Bank in 2018, 2019, 2020 and 2021. Monzo scooped this award in 2022, but Starling still won the coveted “Best Current Account” award.

It is FSCS protected, meaning that if it went bust you would be protected up to £85,000.

They don’t have physical branches, but they do offer personal accounts for:

- Joint and personal

- Euro bank accounts

- Children’s debit Cards

- Teen accounts

and for businesses

- Business accounts

- Sole trader accounts

- Multi-currency accounts

They also have a customer services line where you can speak to a real person.

Are There Any Fees? – Personal

Personal accounts are free, but you’ll have to pay an extra £2 a month for additional accounts.

If you want to deposit cash you can do so at a Post Office. The first £1,000 of this is free. Above this will be charged at 0.7%. You can’t deposit more than £5,000 a year physically into the account. There is no such charge or limit for non-physical deposits.

Sole trader and LTD company business accounts are free – unless you want to use the

Are There Any Fees? – Business

Business accounts for LTD companies and sole traders are free. You can add access to the Business Toolkit – a built-in accounting software suite that links to your account (sort of similar to Xero or Quickbooks) for £7 a month.

Features We Like- Personal

- Free international spending and ATM withdrawals (this is super cool).

- Mastercard debit card.

- Overdraft options.

- Card blocking tools.

- Categorised spending insights.

- Split bills with a payment link.

- Send money to nearby Starling customers.

- 24-hour customer service.

- Saving Spaces – basically ways to add money to pots to save for particular goals (more details here)

- Round up feature – rounds up your spending to the nearest quid and sends it off to a Savings Space of your choice. This then gets a small interest added on.

- 0.05% AER on balances up to £85,000.

- Can set up a personal euros current account and use the same card. This means you can send and hold euros for free. You can also exchange money at the real mid-market rate with a very competitive 0.4% conversion fee applied. Great for people travelling around Europe.

- Starling Kite – allows you to set up an account for your children so they can learn to manage their finances.

- Connected cards – you can give someone you trust a card with a spending limit of £200. this is super useful for people who have carers.

Features We Like – Business

- Free international spending and ATM withdrawals (this is super cool).

Mastercard debit card. - Ability to schedule payments.

- Add digital receipts to payments.

- 24-hour customer service.

- Integrate with accounting software or use the in-built business toolkit.

- Up to £150,000 overdraft for businesses.

- Up to £10,000 overdraft for sole traders.

- Can set up Business USD and EUR accounts so you can exchange currency at the real mid-market rate.

- Access to a 3.25% savings account – though you have to keep your funds in this account for a 12 month period.

Features We Don’t Like – Personal

It may be a great experience, but the one area Starling is lacking is rewards. Apart from the 0.05% interest on balances up to £85,000 (which isn’t exactly earth shattering), you won’t be getting much going back into your pockets for banking with Starling.

Overdraft interest can meanwhile be charged at 15%, 25% or 35% depending on your credit score.

Starling also doesn’t currently offer loans.

Features We Don’t Like – Business

You can only make deposits at Post Offices and the limits depend on the particular post office. you will also be charged 0.7% interest on this with a minimum charge of £3. If you run a cash-heavy business, then this account may not be for you.

How good is the app?

Quite simply excellent. The Competition and Market Authority who do a huge survey of banking customers each year reckon it’s the best on the market with 86% of customers likely to recommend it to a friend. It also has a rating of 4.8 on Apple’s App Store and 4.6 on Google Play. Users frequently praise its features (e.g. saving pots and detailed spend breakdown by category) and ease of use.

Positive User Comments

We spend hours reading user comments to see what feedback people are giving. Here are some positive comments that stood out to us:

5/5

Really happy with my new Starling account. The app on both Android and iOS is easy to use and allows me to manage my finances in an easy way.

So far the things that I have enjoyed most:

- Savings pots

- The ability to select a payment and split it with others, sending an easy link to pay.

5/5

What a breath of fresh air! I have banked with various banks I various countries, and always ended up having a negative experience after empty promises were made. I eventually got tired of needed a minimum balance in my business account in order to avoid ridiculous bank charges AND a monthly fee, so I switched to Starling. I’m so glad I did.

No charges, no minimum balance, no needless paperwork, no hassle. The app is intuitive and helpful, as well as easy to use and (it looks) secure.

If you have a small business and don’t need to network with your bank manager, then I strongly suggest switching to Starling. You get a bank card for the business, and the app is great. You also don’t need various savings account to set money aside, as you can do so in the app while all the money technically stays in one account.

I’ve been at Starling a few months now, and so far it’s been a pleasant experience, which is more than I can say for most other banks.

5/5

Wow! I decided to change banks and opened an account with Starling. I completed the simple process of requesting a switch. The whole process took 5 days and all my stop orders and direct debits were transferred seamlessly.

The communication throughout was excellent.

The app is simple to use, with very useful information and features to help manage your account.

Simply brilliant!

Critical User Comments

1/5

Sadly I have not had a good experience of Starling Bank and have decided to leave. To open the account back in September ’21 I was put thought a ridiculous inquisition about my business and was even asked to submit a business plan to them. I was not wanting a loan, just to open an account! I have been with them until now and this week have asked to open a second account. I have over £12,000 in my present account and have an excellent credit rating. However they told me that they would not be able to open another account for me for reasons that they were not prepared to explain. It was all very odd. I since opened an account with HSBC which was applied for, opened and receiving my money into it within 1 hour. What a shame Starling have been so difficult. I would potentially have 2 accounts with them now but as it is I am moving my money out and will soon have no accounts with them. Beware, there are a definitely friendlier and more efficient banks out there!!

1/5

I want to start by saying what a great bank, that is until you want to transfer money out and purchase a car, a simple and basic task of running a bank. Once the fund had been transferred out, they then locked the account so i could not add money or transfer out money.

After spending 4hrs on the app, with tension high, they finally threatened to close my account, hallelujah. Now send me the cheque so i can use a bank which looks after clients.

They want you money, but please don’t try and spend it, total amateur banking practises.

1/5

I’ve been a Starling bank customer for a while now. Even though I’m on top of my finances and never missed a payment etc. to lose their trust, they dropped my credit limit! In return I cancelled the remaining limit so they can no longer charge me any interest. There are much better banks out there who does business professionally and way better.

Is Starling A Good Bank?

The simple answer is yes. Its digital experience is hard to beat. If only it offered cashback or a switching offer we would put it as our number one choice. As it stands Starling Bank is ranked #3 of 25 personal current accounts in the UK (Click to see our top 10).

Are there better current accounts on the market? We’re calling out the following accounts as excellent:

They have a grade score of 76 - ranking them as the second-best UK bank. A long-standing reputation, great digital experience and top-notch customer service make them an excellent choice for most people.

We are sorely missing their £175 introductory offer however and hope they bring it back to market soon.

To qualify you to switch to open an account online or using the app and switch another bank account to them (including two Direct Debits).

If you are looking for a first class app experience then our scoring puts Starling ahead of rival Monzo.